LEXPERT: From the outside, this deal looked like it was doomed by the news events swirling around it. How did the deal teams manage to save this one?

Rubin Rapuch (Fasken Martineau DuMoulin LLP, for Concordia): This deal did not require saving. What was happening outside was market noise, albeit loud market noise.

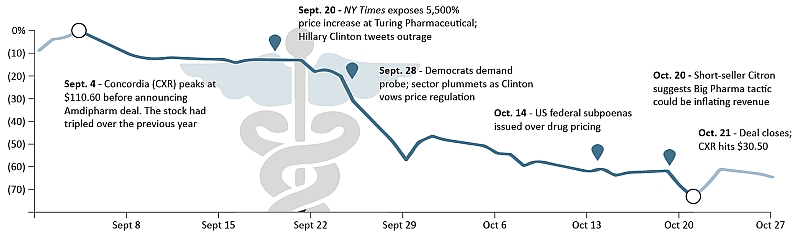

John Emanoilidis (Torys LLP, for Cinven): The parties signed on just before the drug-pricing controversy unfolded in the press, but all parties remained committed to the transaction. They continued to see significant value in the deal and were willing to do the hard work to get to closing.

Rapuch: If a transaction makes economic sense, the transaction in all likelihood will be completed, regardless of extraneous market conditions. The Concordia acquisition of Amdipharm occurred during a period of unsettled capital markets and health-care sector conditions, but these events were extraneous to the transaction. They made for some challenges, but the economic fundamentals of the transaction made sense for the parties and therefore prevailed.

LEXPERT: Before we get into those challenges, let’s start with the initial environment. What was the logic behind this deal?

John Sabetti (Fasken): Concordia has a strategy of growth through acquisition. It determined that the economic metrics and other features of the Amdipharm acquisition – including product diversification and geographic exposure – satisfied its criteria and fit well within its growth strategy.

LEXPERT: How would you describe the negotiations? Friendly? Guarded? Tense? Did that change as the news began to unfold?

Sabetti: The definitive acquisition document was signed prior to the change in market conditions, so they did not really factor into the deal. That being said, given the tight timeline set for the transaction, I would characterize negotiations as intense but efficient and co-operative.

Emanoilidis: The parties and their advisors were all seasoned deal-makers and had plenty of experience with the unexpected twists and turns that can arise on any transaction. Despite the unexpected developments, everyone involved remained focused on getting the deal done.

LEXPERT: Okay, let’s get to those developments. About two weeks after this deal was announced, The New York Times came out with the story about Turing Pharmaceutical and how it had inflated prices. The very next day Hillary Clinton started an avalanche in the health-care sector when she tweeted her outrage. What was going on in your respective deal camps?

Rapuch: The timing of these extraneous events was unfortunate, but the business, financial and legal teams proceeded with a focus on expediency and efficiency to mitigate these events to the extent possible.

Emanoilidis: We all kept a close eye on the controversy as it unfolded, but everyone continued to drive forward to execute on the deal, despite the new challenges introduced by what was going on in the media.

LEXPERT: Then, after Clinton voiced her outrage, a short-seller’s report suggested that Valeant Pharmaceuticals could be inflating its revenue — and that sent the entire sector plummeting. From the date of announcement to date of close, Concordia’s shares fell over 70 per cent. Did the prospect of equity financing vanish?

Sabetti: The funding for the deal was fully committed at the time of the acquisition’s announcement. What was uncertain was the ultimate mix of equity, notes and credit facilities, and this was ultimately determined in the context of the market.

Emanoilidis: The parties all believed that there continued to be good value in the deal and that the acquisition could still be completed on its original terms. The parties and their advisors worked very hard to make sure that happened, even in the face of what was happening to share prices across the sector.

LEXPERT: I imagine this kind of deal creates a great deal of uncertainty. How did you advise your respective clients in the media maelstrom?

Emanoilidis: Our client, Cinven, has a significant history as a leading private-equity firm, so they were very experienced and knew how to deal with unexpected events that can sometimes arise in completing a transaction. They remained unfazed and focused on execution, despite the uncertainty, and we worked with them to help them achieve that.

Rapuch: These events, if anything, caused everyone to more acutely focus on completing the deal expediently and efficiently.

LEXPERT: Aside from the market panic, were there any other risks to this deal? Did the international aspect of it present any interesting regulatory challenges?

Emanoilidis: We helped Cinven navigate the North American securities regulatory landscape relating to their acquisition of Concordia shares. While there was no deal risk, this was Cinven’s first encounter with the Canadian regulatory landscape, and we worked with them to ensure that this aspect of the deal went smoothly for them.

Sabetti: One interesting aspect of the acquisition related to some of the deal terms that were rather customary in the UK, particularly where the seller is private equity, but that are less common from a Canadian or US legal perspective. This involved some familiarization with local market practice, but in the end the definitive acquisition document was a reasonable mix of UK, US and Canadian M&A practice.

LEXPERT: I’ve read that some protective measures were worked in for Concordia with respect to activist shareholders. As I understand it, Cinven acquired a stake in Concordia, but only on the condition that the shares were not to be re-sold to a group of activist shareholders. Why was this feature of the deal introduced?

Sabetti: This restriction is relatively common in US health-care M&A, but seemed to garner a disproportionate and, I would say, unwarranted amount of attention in Canada. As Cinven would be acquiring more than a 10-per-cent block of Concordia shares, it would be subject to a customary standstill. The restriction simply prohibits Cinven from reselling the shares to certain investors that are commonly recognized as activist investors in an off-exchange trade. It does not restrict resales to activist investors in other ways, such as through stock exchange sales or secondary sales pursuant to Cinven’s registration rights. Philosophically, this restriction was a natural extension of the standstill. If an activist wanted to acquire a block of shares from Concordia directly, it would be subject to a contractual standstill.

Emanoilidis: Restrictions on re-sales to activist investors had recently been implemented in a number of similarly structured pharma deals internationally. It was only a matter of time before these restrictions were introduced in a Canadian context. It was not surprising that Concordia would request various trading and standstill restrictions in this deal, as Cinven would become a significant shareholder post-closing.

LEXPERT: What would you say was the most interesting or memorable aspect of this deal? Was it enjoyable despite the mayhem in the news? Or because of the mayhem? Is this the kind of deal that gets the adrenaline pumping?

Sabetti: Yes, there definitely was some adrenaline pumping. Being a part of Concordia’s successful completion of a transformative M&A transaction, together with a public-equity financing, a private placement of notes and the implementation of several credit facilities in a short timeline – and all in the face of extraneous events and unsettled markets – made the transaction both enjoyable and memorable.

Emanoilidis: The deal teams were very aware of the developments in the press surrounding the deal. This kept us very excited about successfully completing the acquisition and helped keep us all focused on achieving a great outcome for the parties.

(For a complete list of legal advisors, click here.)