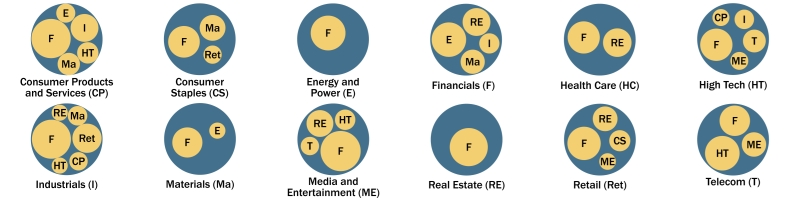

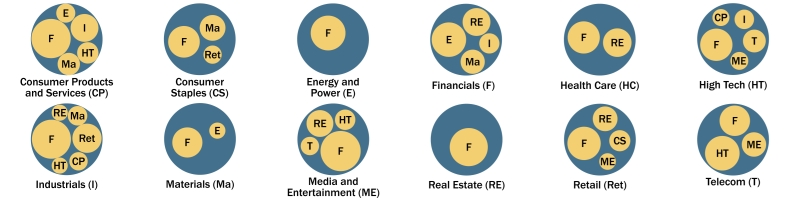

A 10-year analysis of Canadian M&A deals

(over US$50 million) shows which sectors are most likely to

“cross-pollinate” by acquiring assets and entities in other sectors.

Whereas finance and private-equity players are represented across the

gamut, energy and real estate entities most often merge homogenously.

Dealmakers in the high-tech, media and telecom categories also

intermingle.